The second quarter reverses the trend at the beginning of the year to generate results similar to pre-pandemic levels

Gabriel Escarrer, Executive Vice President and CEO of Meliá Hotels International: The Group's results in the first half of the year prospered due to the strong recovery in travel on a global level, particularly in leisure travel in both resort and city destinations, a segment in which Meliá has a significant leadership, as well as the return of international travel after a couple of years of travel and border restrictions. Our company is therefore one of the ones that have benefitted most from the exponential increase in demand, thanks to our strong direct sales channels and the revenue optimisation allowed by a high degree of digitalisation (with a new version of melia.com which is even more versatile, experiential and multi-channel). This is further enhanced by our positioning in sustainability, where we place first in the European ranking according to Standard&Poors Global, in a society that is attaching increasingly greater importance to social and environmental responsibility in regard to travel.

The trends behind our results in the first half of the year are undoubtedly the very strong growth in travel demand, described by some as “revenge travel" as a reaction to the travel restrictions experienced by the world's population. This demand is largely accompanied by reduced price sensitivity, a factor that is less important than quality, safety and flexibility in the mind of post-Covid travellers. Given the complexity and uncertainty in the business environment, at Meliá we've taken full advantage of this "favourable wind" to consolidate our strengths, enhance our assets and adapt them to the new requirements and expectations of travellers who are eager for experiences and more likely to choose higher quality and luxury products and rooms, a segment that continues to lead the increase in demand. All of this creates a "virtuous circle" that has allowed us to double the rate of growth in the first half of the year, with 18 new hotel openings, and which will certainly help us to continue growing and restoring value."

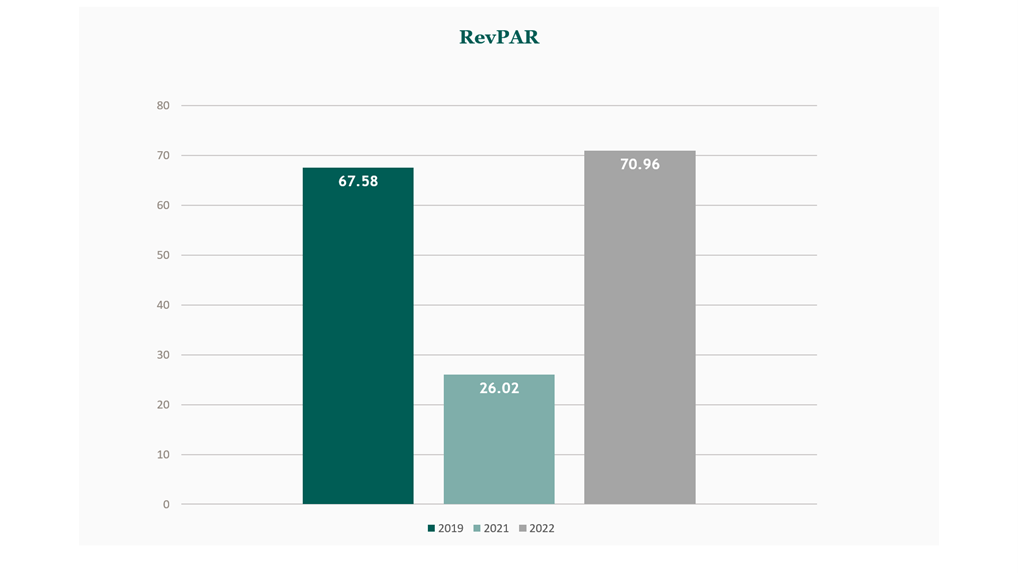

Meliá Hotels International has presented results for the first half of 2022 which add to its confidence in overcoming the consequences of the pandemic and point towards a very positive third quarter, both due to strong pent-up demand for resort hotels built up over the past two years, and the better than expected performance in city hotels, which in some cases have achieved results above pre-pandemic levels. The company obtained a positive net profit for the period of €3M, (+102%), closed the semester with an EBITDA of €163.3M, and met its objective of generating a positive cash flow ever since overcoming the impact of the Omicron variant. Consolidated revenue excluding capital gains (€741.5M) increased by +222.6% up to June compared to the first half of 2021, and by +206% in the second quarter itself (€470.1M), just -1.3% behind the same period in 2019. On the other hand, effective cost control, jointly with rate optimization achieved thanks to its digital capacity, the product enhancement and the focus on luxury hotels and rooms, allowed Meliá EBITDA margins similar to 2019, despite the impact of inflation.

In general, the first half of the year saw a change in trend with respect to results in the Covid period, with a strong increase in demand leading to figures which were already above pre-pandemic levels in some destinations in the second quarter. Forecasts that the strong impact of Omicron would give way to a return to normal and learning to live with the virus have been met in full and accompanied by a strong boost in demand. Neither the successive, less virulent waves of Covid nor the uncertainty and inflation caused by the war in Ukraine have been able to dampen the desire to travel.

Also of note is the return to normal in the segments most affected by the pandemic, such as tour operator and travel agency sales, both traditional partners of Meliá. This is a change which is welcomed by Meliá as a complement to its direct sales channels, which already generate 44% of all centralised sales and are the top sales channels in markets such as Mexico. The company expects direct sales to rise to 50% in the medium term in a fully normalised travel and distribution environment.

The recovery continues to occur at different speeds for different segments. While the performance of city hotels was better than expected, the improvement is most notable in major cities such as Madrid, Barcelona or Seville, with growing activity in the MICE segment, and less so in second-tier cities. Cities with a higher leisure component such as those in the Mediterranean present a better outlook, with double-digit growth expected compared to 2019.

The company highlights that RevPAR (Revenue Per Available Room) in the second quarter was higher than in 2019, mainly due to higher average room rates rather than higher occupancy, which was still below pre-pandemic levels.

Strategic growth

Leveraging its leadership in the resort segment to grow its managed and franchised hotel portfolio, Meliá continued to add hotels under its Meliá, Gran Meliá, Meliá Collection and Affiliated by Meliá brands in the top destinations in the Mediterranean, Caribbean, Middle East and Southeast Asia.

After adding 25 hotels to date (15 in Vietnam, 3 in Albania, 3 in Mexico, 2 in Spain, 1 in Portugal and 1 in Italy), the company confirmed the objective announced at its Annual General Meeting to sign up at least 40 new hotels with more than 9,000 rooms in 2022. The opening pace also intensified and the Group opened 18 hotels year to date.

Meliá Hotels International sees significant growth opportunities for well-known brands with strong distribution capabilities, viewed as a "safe harbour" for independent hotels and small hotel chains that do not have the brand strength, distribution systems and economies of scale that Meliá can provide. Considering hotels in operation and also those in the pipeline, the company already has 58 “Affiliated by Meliá" hotels and 8 “Meliá Collection" hotels.

Results by region

SPAIN

- In city hotels there was a stronger performance from hotels in the major cities thanks to greater international travel and more congresses and group reservations in general, although still behind 2019 levels. Mediterranean cities such as Palma, Barcelona and Valencia ended June with results above those of 2019.

- Resort hotels have recovered, and even brought forward their opening in the Balearic Islands, with huge last-minute demand from both individual travellers and groups.

- Luxury hotels lead the way in terms of increases in revenues and rates, and the demand for superior rooms and suites is also increasing.

- There is optimism for the third quarter in both city and resort hotels. City hotels which combine leisure and business travel, such as Palma, Alicante, Valencia, Coruña and Cadiz, are expected to do well, while resort hotels expect to see double-digit increases in average room rates, mainly in luxury destinations such as Marbella, Ibiza, Tenerife and Fuerteventura and with greater revenues from superior rooms.

EMEA

- There has been a solid recovery in Germany since April, with improvements in all regions, rate increases, and growing activity in congresses and trade fairs

- In France, Paris followed a similar trend to other major European cities and saw business improve from March. Highlights included the improvement in the average rate in the two hotels rebranded to Meliá Collection in the centre of Paris: Villa Marquis and Maison Colbert.

- In the United Kingdom, demand reached similar levels to 2019 in London, with the reactivation of corporate travel and MICE business in May and June.

- In Italy, hotels have recovered since the end of travel restrictions at the end of April, with a return of the MICE segment to Milan in May and improvements also in Rome.

- The outlook for the third quarter is positive in all European markets

AMERICAS

- In Mexico, hotels improved revenues compared to 2019 thanks to the lifting of travel restrictions and increase in the number of flights to our top destinations. A full recovery was seen in the second quarter in all segments, with a very positive performance from melia.com, which already channels 30% of all sales. Prospects are positive in all segments for the third quarter.

- In the Dominican Republic, Paradisus Palma Real remains closed for renovation, and work continues on repositioning Meliá Punta Cana Beach in the wellness segment, in spite of the impact of the absence of travellers from Russia. For the third and fourth quarters, the long-awaited renovation of the iconic Paradisus Palma Real, the repositioning of the Meliá Punta Cana Beach as the only all-inclusive adults-only resort focused on the wellness segment, and the inauguration in December of Katmandu Park, point towards a strong improvement in results for the high season.

- In the USA, Orlando has seen results above those of previous years in all of its KPIs and all customer segments. In New York, occupancy and rates also grew thanks to an increase in business and international travel. Cautious optimism for the third and fourth quarters.

- Cuba: although still not achieving results similar to those prior to the pandemic, Meliá now has 20 hotels open and has seen significantly more activity, especially after the resumption of flights from Canada, and despite the absence of Russian travellers due to the war in Ukraine. Demand is expected to continue to grow thanks to the removal of restrictions and strong demand from markets such as Portugal, Spain, the Netherlands, Germany and Argentina, along with Canada.

ASIA

- China: the zero-tolerance Covid policy extended into the second quarter continued to limit travel demand. Forecasts expect levels similar to 2019 in hotels, with price improvements due to growing demand in the MICE segment

- Southeast Asia: The total relaxation of border restrictions in the key destinations in the region has led to a strong recovery in international travel to most hotels, highlighting the performance of the hotels in Bali, which reached pre-pandemic occupancy levels in June.

-

Non-Financial Information Statement

In the first half of 2022, Meliá continued to make progress in making sustainability an integral part of its business model and a key driver of value creation for stakeholders. "Responsible Business" is one of the top priorities in the strategic roadmap for Meliá Hotels International during this recovery period.

The company cannot ignore the complex social, economic and environmental context in which it does business, and must also take on board new and challenging regulatory changes which affect companies in very diverse areas, forcing them to identify the financial impact of their value chain from a sustainability perspective. That is why it has continued to work on the new EU Taxonomy over the first half of the year, aligning 3 key indicators (Capex, Opex and Revenue) with the adaptation and mitigation objectives in terms of climate change, with a view to meeting the mandatory reporting requirements in 2022.

As part of its objective to contribute to the Sustainable Development Goals and be seen as a global benchmark for excellence, responsibility and sustainability, the company has launched the “Travel for Good" project which includes its responsible business strategy (ESG) to drive sustainable tourism and become a better company for the planet. Travel for Good is built around the different ESG dimensions in which significant progress has been made during the first half of 2022:

In the environmental dimension, the "Good for the Planet" initiative encompasses all of the projects in areas such as energy efficiency, sustainable construction, responsible water management, circularity and biodiversity.

One significant milestone in this area is the construction and preparation for inauguration this week of the Gran Meliá Villa Le Blanc Hotel in Menorca, which will become the company's first carbon-neutral hotel and which brings together all the company's vast experience to define a path for new hotel concepts. The hotel will reduce its carbon emissions (scopes 1 and 2) by 87%, and will explore different alternatives to offset the remaining 13% to ensure its carbon neutrality. The Co2PERATE project is also using artificial intelligence to improve the monitoring and measurement of energy use, and has now been implemented in even more hotels, meaning that 80% of the hotels now monitor, analyse and improve their energy performance. This has generated savings in CO2 emissions in 2022 of around 2.4 Tn.

Meliá has also partnered with the technology company CREAST to develop a system for measuring the carbon footprint of hotel events, with the objective of developing more sustainable and efficient value propositions for the MICE segment.

In the social-employment dimension, our strategy includes a number of projects focused on employees under the slogan “Good for our People". Over the first semester the company managed to reincorporate 99% of its employees after a pandemic that saw us have to put 73% of them on furlough. Meliá has also deployed a number of different initiatives to enhance employability and attract new talent in a highly competitive environment, especially in strategic destinations such as Spain, Mexico, the Dominican Republic, Western Europe and Southeast Asia. The company is working with numerous universities and tourism schools and has signed new partnership agreements with prestigious organisations such as IE, VATEL, Les Roches, CUNEF, ISDI, etc., while also reaching out to the academic world through several partnerships and "open-door" and "talent-day" events in some of the best tourism schools, such as Glion, Les Roches, Lausanne, Sant Pol and The Valley, as well as universities such as the UCM or the Balearic Islands for internship agreements.

In the area of diversity, Meliá has been named among Europe's Diversity Leaders 2022 by the Financial Times, standing out among the top ten Spanish companies considered leaders in diversity in areas such as age, gender, ethnicity, disability, or LGTBQ+. In regard to the latter, Meliá has recently announced an agreement to award a number of ME by Meliá hotels the Queer Destinations Committed certification. Certification is based on a number of standards defined by the IGLTA (International Gay and Lesbian Travel Association) to help companies and destinations better prepare to provide an appropriate and safe welcome to the LGBTQ+ travellers that represent 10% of the global travel market.

Finally, the “Travel for Good" strategy also includes projects designed to continue to enhance corporate governance under the slogan “Governance for Good", with milestones in the first semester including the appointment of another female Director to the Board of Directors to take the ratio of female members to 36.4%. Another milestone was the award for "Best Compliance Team 2022" at the Iberian Legal Summit Awards for achievements in compliance, transparency, data protection, crime prevention, anti-corruption and money laundering, among other areas. The company was also classified as Gold Standard in an assessment by ECOVADIS which analyses non-financial management systems in companies that are or aim to become Meliá suppliers, thus reducing risks and improving the alignment of suppliers with its ESG commitments in areas such as environmental impact, employment practices, human rights, ethics and sustainable purchasing.