The Group's revenue in the year to June was +4.7% up on 2019

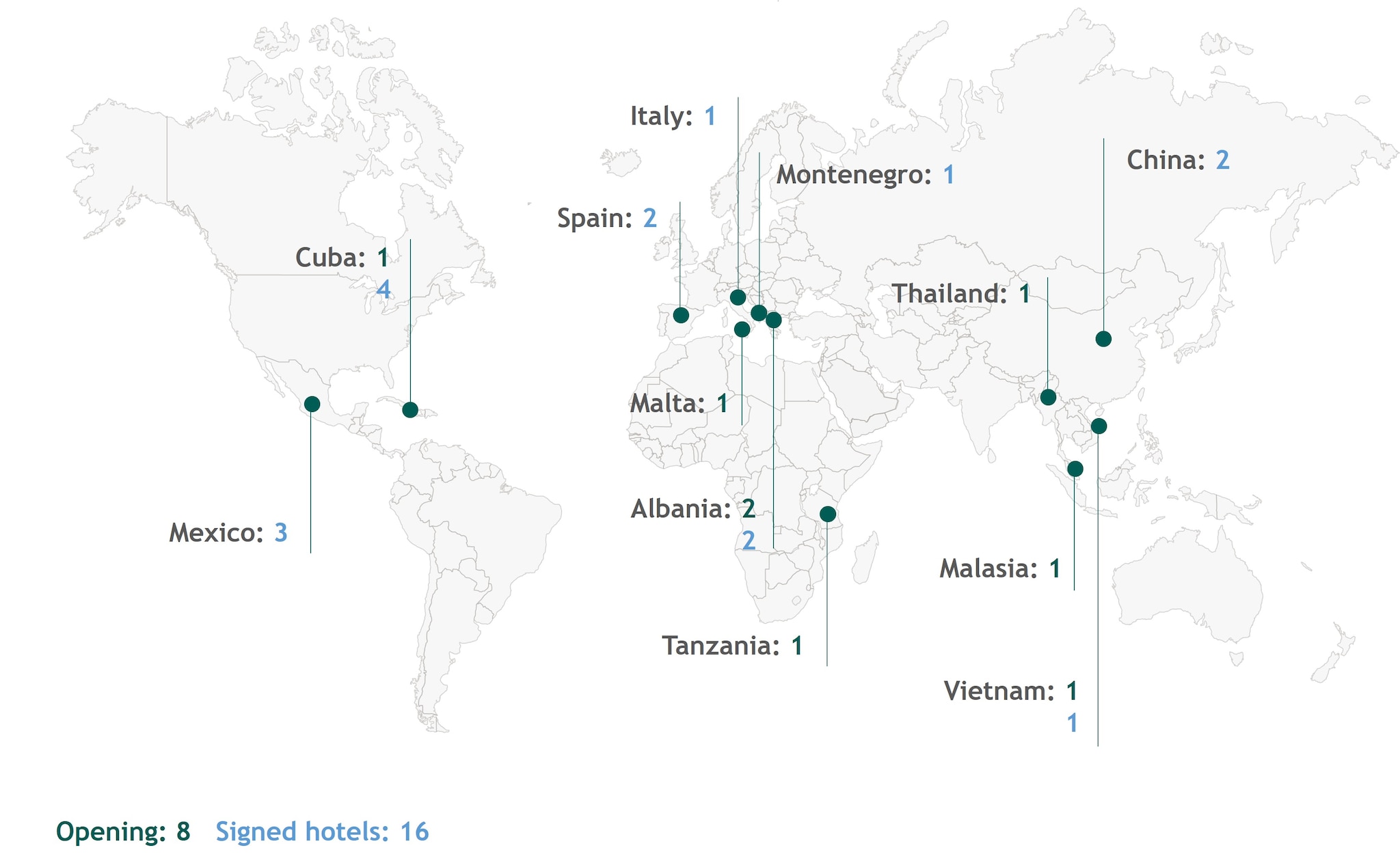

RevPAR (Average Revenue per Available Room) continued to grow, surpassing 2019 levels for 4 consecutive quarters now and highlighting the improvement margin though occupancy rates compared to pre-pandemic (-7,7%)

Demand remained solid for “bleisure" urban hotels and holiday hotels, without any signs of a turnaround despite macroeconomic and geopolitical uncertainty

A positive outlook for the 3rd quarter in all geographical areas where the Company operates

Gabriel Escarrer Jaume, Meliá Hotels International Chairman and Chief Executive Officer:

“The Group's performance in the first half of the year continued to benefit from the recovery dynamics that began 15 months ago now, with the second quarter recording a very positive level of revenue, and so far, we have not seen any signs of a slowdown despite macroeconomic uncertainty. The steady improvement in demand, with 34.56% more reservations this season at our Spanish holiday hotels–in monetary terms–as compared to the same dates in 2019, also surpassing in double digits those of 2022, together with the positive outcome of marketing campaigns such as the recent “Wonder Week"– which resulted in 18% more reservations than the previous year–allow us to reaffirm, with cautious optimism, our expectations to achieve at least 475 million in EBITDA for 2023, also surpassing the revenue and net profit recorded in the previous year. The MICE business has recovered very well, too, including important segments such as Groups, Conventions, Events and Incentives, as well as the Corporate segment, where Meliá has fewer rooms, and which is the least dynamic. We also witnessed the total normalisation of the Tour Operation segment, which is crucial to complement our direct sales and already accounted for more than 46% of our total centralised sales. The MICE business confirmed to date is +30% higher than that registered on the same period of 2022.

As the global tourism industry continues to grow, driven by the increasing priority that post-pandemic consumers are placing on travelling over other expenses in goods and services, our Company is also benefitting from a strategy that has enabled it to build on its strengths, such as its leadership in the holiday segment or its digital and distribution capabilities, and move forward in its transformation. One example of this is our expansion strategy under “asset-light" models which allow us to grow in a more dynamic, strategic manner, relying less on financial and real estate leverage and increasing the value of our brands, our management and distribution system, and our positioning in terms of Sustainability and people.

By end-June, our Company also took a great step forward in Corporate Governance, as we completed the generational handover at the helm of the Group through an orderly and well-planned transition. Combined with the reinforcement and partial renewal of the Executive Committee, this shall ensure the continuity of our solid values while also strengthening us in the face of the new challenges of the context. All of this indicates that we are on the right track, moving closer to a full recovery from Covid-related impacts and towards building a more profitable, sustainable and resilient company, as envisaged in our Strategic Roadmap until 2024."

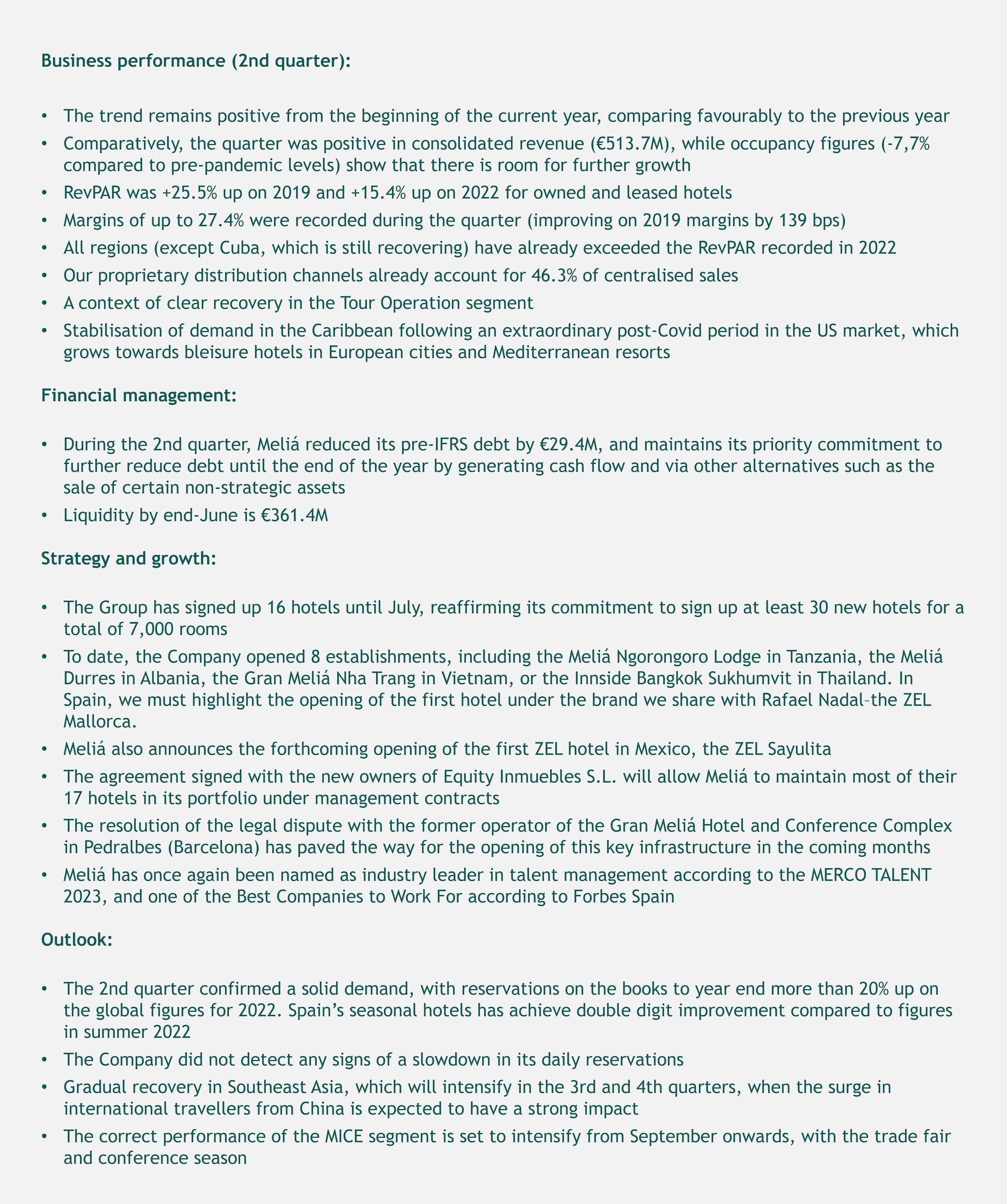

Revenue evolution

(€M - excluding capital gains)

Meliá Hotels International has presented its results for the first half of 2023. Though not fully comparable to the same period in 2022 (due to the impact of the Omicron variant during the 1st quarter of the past year), they point to the strength of a steady demand and herald a better 3rd quarter than the past year, with expected occupation levels and prices slightly above the previous summer. The outlook is especially positive for Spanish and European holiday and urban leisure or “bleisure" destinations, and somewhat more difficult, although improving on the previous summer, for urban hotels in the corporate segment.

During this period, the Company recorded a positive net attributable profit of €46.2M (vs €3.7M in 2022), and closed the semester with €218,5M in EBITDA (+33.8%), which points to the achievement of at least 475M target set by the Group's Chairman during the past General Meeting. Consolidated revenue excluding capital gains (€909.7M) rose by +22,7% in the year to June as compared to the first half of 2022, and by +9.3% in the 2nd quarter alone (€513.7 M), which is already ahead of the same period in 2019 and speaks of a positive 2nd quarter.

The 2nd quarter confirmed the return to normal levels in the tourism industry, maintaining the upward trend recorded in the 1st quarter of the year. Pre-pandemic RevPAR has been consistently surpassed for 4 consecutive quarters now, and until June 2023, all regions except Cuba exceeded 2022 RevPAR figures. In the 2nd quarter alone, RevPAR rose by +15.4% vs 2022, and by +25.5% vs 2019. Together with improved rates, occupancy data continued to rise as compared to 2022, +15.63% until June, even though 2019 levels have not been reached yet. Thus, the Average Occupancy in the 1st half of 2023 for our owned and leased hotels was 65.9%, -7.7% below that registered before the pandemic.

We can confirm a general recovery in the international markets, with special focus on the Asian markets, as well as the remarkable reactivation of the Corporate and Conferences & Events segments. In the Caribbean, demand started to stabilise following an extraordinary post-Covid period in reservations from the US market, which continues to grow in our European hotels, both in the bleisure segment (in tourist cities) and in Mediterranean resorts. Thus, the US is already the first market for destinations such as Rome, the second market for destinations such as Ibiza and Madrid, and the third market for destinations such as London.

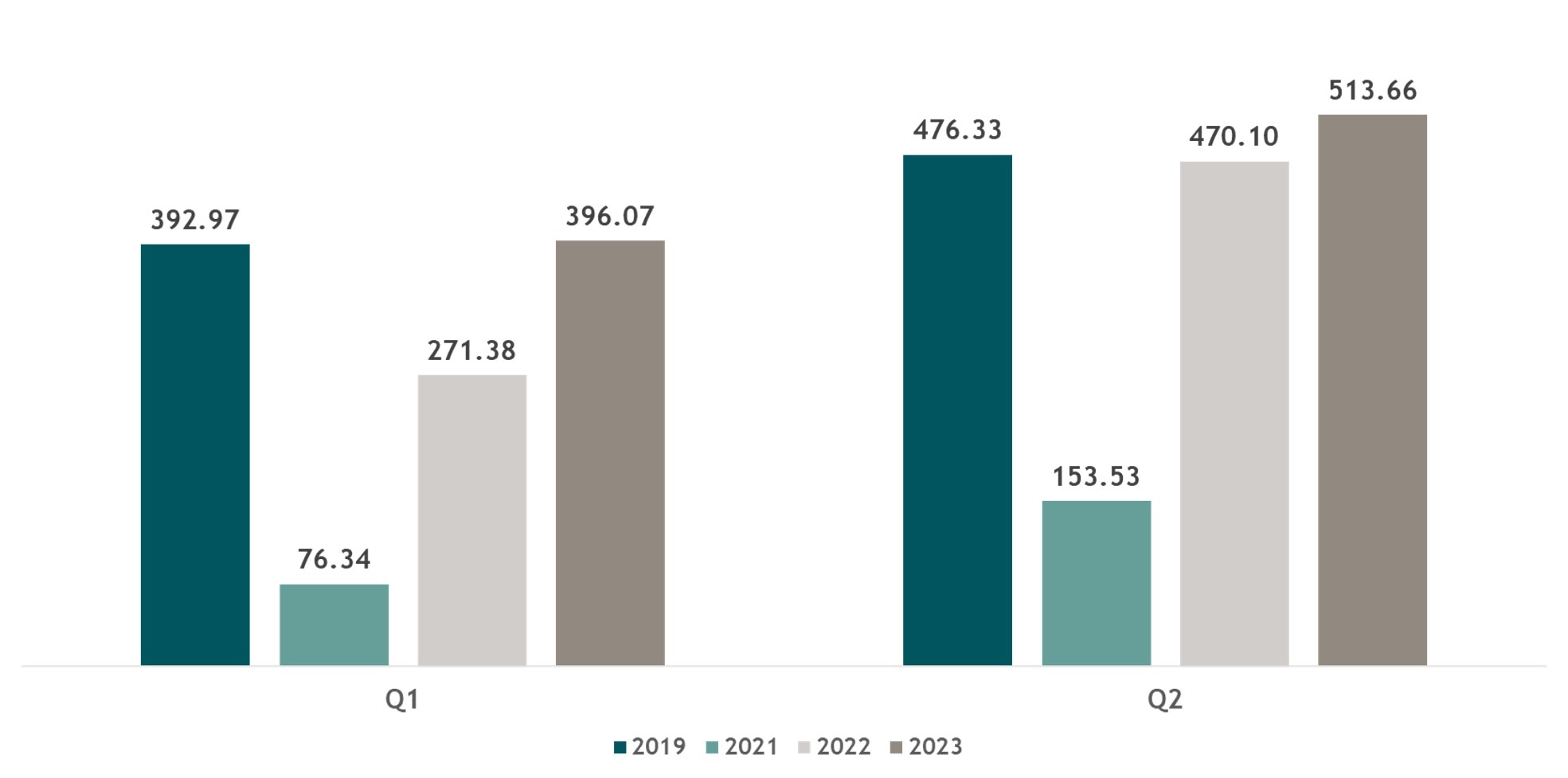

Sign-ups and openings in 2023

New hotel sign-ups and openings

As far as expansion is concerned, the Group has signed up 16 hotels until July, reaffirming its commitment to sign up at least 30 new hotels for a total of 7,000 rooms. Among the most relevant milestones, we can mention the sign-ups of the future Gran Meliá Tirana and Gran Meliá Palasa at the beginning of July, which represent the entry of the Gran Meliá brand in Albania, both in its capital city and in one of its main Leisure destinations, thus consolidating MHI's position as the main international operator in that country. Furthermore, the sign-up of 4 new hotels in Cuba will further strengthen MHI's position in the country, with some of these openings taking place as early as 2023, as is the case of the Innside Habana Catedral, opened on June 1, and the Hotel Sevilla Habana, Affiliated by Meliá, which is scheduled to open in September 1.

The Group must also highlight the sign-up of its first hotel in Mexico under the ZEL brand, which Meliá shares with Rafael Nadal—the future ZEL Sayulita; In the same destination, the company has signed the ME Sayulita hotel and promoted the expansion in the country of its luxury brand with the signing of the ME San Miguel hotel, a 140-room hotel that expects to open its doors in San Miguel de Allende in 2025. Likewise, the hotel company also continues its growth in Asia Pacific, with new sign-ups in Asia-Pacific, such as the ME Guangzhou in China, or the Meliá Halong Bay in Vietnam.

As regards its openings during the current period, the Company opened 8 establishments, including the Meliá Ngorongoro Lodge in Tanzania, the Meliá Durres in Albania, the Gran Meliá Nha Trang in Vietnam, or the Innside Bangkok Sukhumvit in Thailand. In Spain, we can highlight the recent opening of the ZEL Mallorca, which raised great expectation. From now until year end, we expect other significant openings such as the Gran Meliá Cordusio in Milan, the ME Sayulita in Mexico, or the Innside Tenerife Santa Cruz, as well as the Palau de Congressos of Catalonia at Barcelona, which Meliá has just committed to carry out in October. This important infrastructure is part of the Gran Meliá Miranda Complex in Pedralbes, including a magnificent hotel which is expected to re-open in January 2024, following the successful resolution of the dispute that the owners maintained with its former operator.

The Company affirms that the evolution in these 6 months is fully aligned with the Roadmap established after the pandemic, accompanied by the fulfilment of a large part of the strategic milestones set for this period in areas such as Expansion, F&B, Revenue, ESG, etc. The promotion of digitization continues to be one of MHI's commitments, taking it to any area where it can be valued and capitalize on efficiency. This leads us to maintain a focus on both the front and back office, apart from Distribution where we continue to occupy a leading position in the industry, and to make progress in improving the relationship with our clients within a more digital framework. The launch of the new digitalised check-in in the Zel brand which eliminates the reception, thus promoting a friendlier and more efficient relationship and automated solution.

Outlook for the 3rd quarter

As concerns the outlook for the 3rd quarter, the Company foresees a promising summer season, as tourist demand remains solid without showing any signs of a slowdown despite inflation and the tightening of financing conditions. To this respect, at global level, daily reservations on the books exceeded by more than 30% (in monetary terms) those recorded in 2019 for holiday hotels, and even those of such a positive season as 2022 (with an increase above 10%).

Regarding Spanish holiday hotels (which account for a large part of our operations in the 3rd quarter due to the summer holidays of our large European and domestic markets), forecasts point to continued strength in rates, both in respect of summer 2019 and the previous year. As to the evolution of occupancy levels, these are expected to be in line with the summer of 2019. Meliá would like to stress the relevance of political stability in Spain following the results of the general election, so that the tourist industry can continue to consolidate its recovery and finally receive the support expected from the Next Generation European Funds, which are crucial to maintain its leadership and competitiveness.

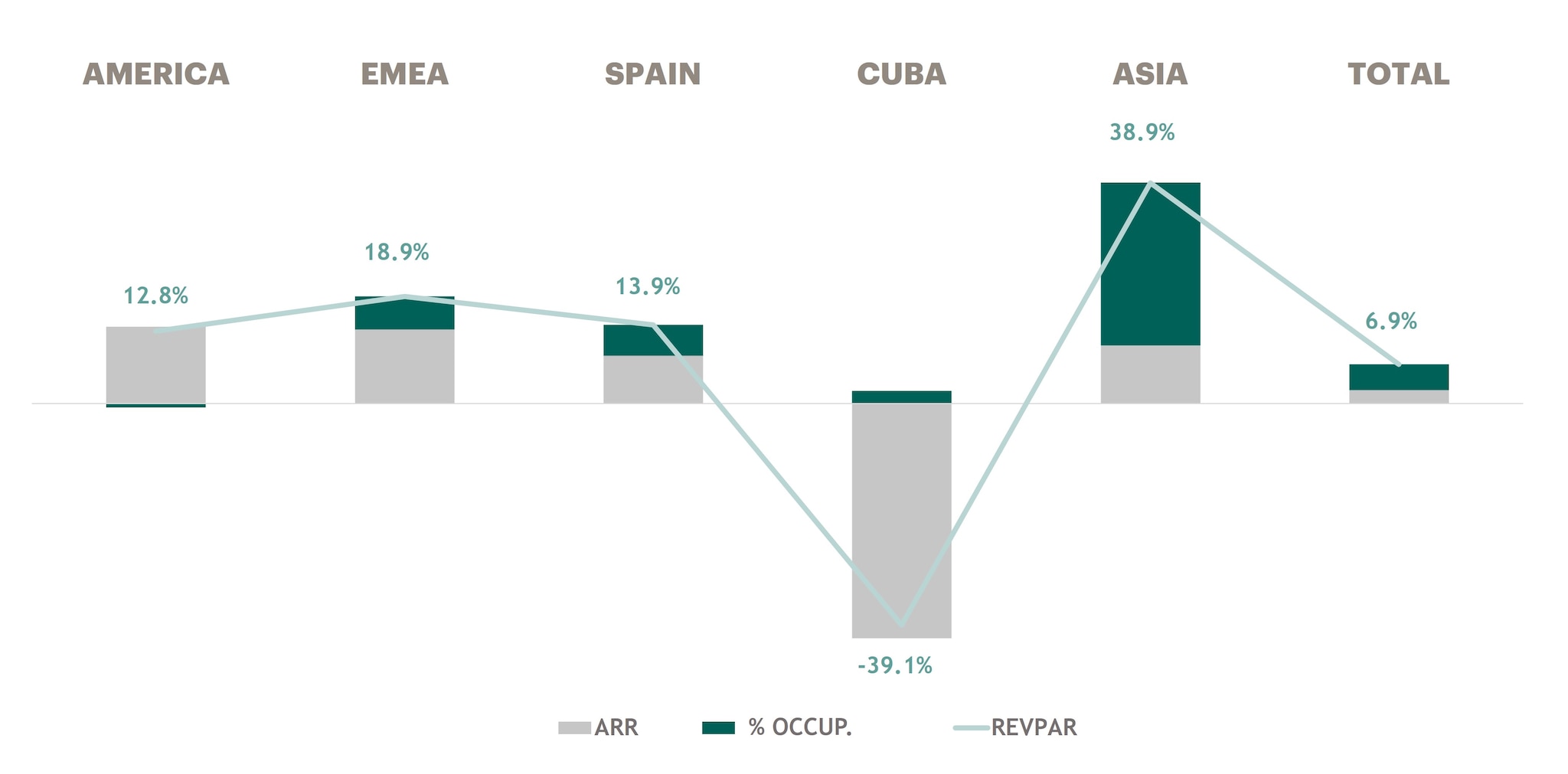

Global evolution of RevPAR

(vs 2019)

Results by region

Spain

The 2nd quarter was very positive for urban hotels, matching pre-Covid occupancy data with prices above those of 2022. Good performance in events and trade fairs, confirming the early recovery of “bleisure" urban tourism as opposed to the somewhat slower recovery of the Corporate segment. For holiday hotels, the strong rates and good occupancy levels, with a very positive Easter, allowed for a 15% increase in revenue as compared to the same period in 2022.

In relation to the 3rd quarter, urban hotel forecasts point to an improvement with respect to the previous year, especially in urban leisure or “bleisure" destinations and hotels (which account for the largest share of the Group's portfolio), also confirming the strength recovered in the Tour Operation segment. As regards holiday hotels, the outlook is promising thanks to a solid demand, already registered in the books, combined with the growth of the main source markets, particularly the British market (which resumed advance sales) and the US market, above all for the Balearic Islands. The Canary Islands are also set to improve in occupancy and prices.

RevPAR evolution by region

(vs same period in 2022)

Germany continued to show a double speed, with a better performance in destinations or cities with a leisure component (like Berlin and Hamburg), and a certain improvement in the other MICE segments thanks to the increase in average prices and demand in certain events. With respect to the 3rd quarter, destinations with a leisure component such as Berlin, Aachen and Hamburg will continue to benefit from the solid performance of urban tourism above cities more focused on the Corporate segment like Düsseldorf and Frankfurt, which are set to recover certain dynamism as trade fairs and events return in September.

France showed significant improvement with respect to the 2nd quarter of 2022, with better occupancy and rates throughout all segments and a record-breaking June in Paris thanks to events such as Roland Garros or the Paris Air Show, as well as the return of Asian tourists. As regards the 3rd quarter, July and September are expected to be positive thanks to the combination of Corporate and Leisure customers.

The United Kingdom saw a clear rebound in the 2nd quarter as compared to the 1st quarter and to the same period in 2022, with a recovery of international customers in London hotels and in the Conference and Tour Operation segments, as well as in the hotels located in the north of the country, which are set to keep on improving in the 3rd quarter thanks to a solid demand in Conferences and in the reservations made via Online Travel Agencies (OTAs).

As regards Italy, occupancy levels are maintained while rates improve, with a remarkable performance of the Conferences and Events segment in Milan. Improved rates in July combined with the evolution of leisure demand point to a positive 3rd quarter both in Milan and in Rome.

The Americas

The 2nd quarter in Mexico suffered the negative impact of sargassum seaweed in the Riviera Maya, resulting in lower occupancy levels with maintained rates. The MICE segment (Conferences and Conventions) led the quarter, followed by the sales made via melia.com and Tour Operators, with the US and Mexico as main markets. These trends are expected to continue during the 3rd quarter.

The Dominican Republic saw a positive performance across all segments, especially in MICE, with the US and Canada as major markets. The repositioning efforts undertaken at our hotels had a positive impact on average rates. Looking ahead to the 3rd quarter, we must highlight the relevance of our proprietary channel Melia.com and the favourable impact of some local conferences and events on the forecasts.

In the United States, Orlando is back to normal as the “revenge" effect disappears, with a stabilisation in distribution by segment and reservations, particularly domestic and leisure ones. As regards New York City, the 1st quarter saw a strong recovery, with levels approaching those recorded in 2019. The 3rd quarter is set to perform well, too, mainly in the melia.com and Tour Operation segments, with a strong growth expected until September, when the Corporate season starts in the city.

Lastly, Cuba recorded an upward trend in international tourism, although the domestic market and the prices weakened, also due to the devaluation of the Cuban peso. Once again, the leading market was Canada, although all source markets grew. The trend is expected to continue into the 3rd quarter—however, commercial offers and more competitive rates, together with the opening of two new hotels in Havana, could boost performance.

Asia

With respect to China, the comparison with the year 2022 is very favourable due to the late lifting of Covid restrictions, with a remarkable improvement in hotel occupancy and rates and reactivated leisure and business segments. The positive trend is expected to continue into the 3rd quarter, thanks to family and leisure travel in the summer holidays and a rebound in the Corporate and MICE segments, with a recovery in international connectivity.

As regards Southeast Asia, Indonesia—particularly Bali—was the best destination in terms of occupancy and rate evolution. Thailand also recorded a good performance, above that of Vietnam. For the 3rd quarter, the Melia Bali and the Melia Koh Samui hotels (Thailand) are expected to perform very well and capitalise on international demand. A rebound in Vietnamese hotels starts to show following the upturn of the Korean market, especially in Corporate and MICE, while we will have to wait until the last quarter to see a recovery of the Chinese source market towards Southeast Asian countries, mainly Thailand.

Non-Financial Information Statement

In the context of Meliá's strategy, the lever known as “Responsible Business", which comprises a number of projects and initiatives covering all three dimensions of sustainability, has continued to make progress during the first half of the year, with the following highlights:

A. In relation to Climate Change and Environment:

- Progress in the sustainable certification of the hotel portfolio: with 28 owned and leased hotels, plus 27 hotels owned by third parties under management contracts, which are in the process of environmental certification by Earthcheck.

- Investments in energy efficiency, with 64 hotels in Spain, Italy, United Kingdom, Germany, Dominican Republic and Mexico with the CO2PERATE Project already in place to monitor, control and manage the facilities and their energy performance. This initiative has been extended to 25 further hotels operated under management contracts. In total, more than 1,755,000 kg of CO2 emissions were saved in 2023, improving on 2022 data by 10%. Likewise, the energy savings achieved through this project have reached more than 5.5 million kWh (+9% compared to the same period in 2022).

- Progress in water management (Magnum Project), with pilot projects in two hotels of the Canary Islands and Mallorca where an AI model virtually “replicates" hotel water facilities in order to improve use efficiency by identifying faults and areas for improvement.

- Circularity Plan. In compliance with the Balearic Tourism Act, Meliá has prepared circularity plans for all its hotels in the Balearic Islands.

- Sustainable Mobility, by expanding the number of charging points for electric vehicles in our hotels, saving more than 6,390 kg of CO2 emissions, and promoting efficient and sustainable transport initiatives among our collaborators.

B. In relation to Social Responsibility, the Company highlights the global challenge posed by the scarcity of and competition for talent, thus placing the focus on aspects such as the following:

- Meliá Hotels International has again been recognized as industry leader in the MERCO TALENTO Employer Reputation ranking, and also been named among Spain's Best Companies to Work For according to Forbes Spain.

- Talent management, by promoting a new “employer branding" vision to attract talent under the motto “Very Inspiring People" (VIP). The initiative seeks to strengthen the appeal and quality of the tourism industry and comprised 12 experiential recruitment days or “Talent Days" with a 23.8% recruitment rate, offering job opportunities to university students during the non-academic season.

- In terms of job creation, 4,324 new employees were engaged during the first half of the year (at our owned and leased hotels), even after having recovered almost all our staff during 2022, with 52.4% of women among the new recruits and a representation of 57.6% in leadership and management positions.

- The Company continued to bet on training and development, with the 1st edition of the Business Analytics & Hospitality Performance MBA in collaboration with the renowned VATEL España school of tourism.

C. In relation to Corporate Governance, we must highlight the changes in the composition of the Board of Directors that took place during the first half of the year, including the completion of the succession process initiated in 2016, with the resignation of Mr Gabriel Escarrer Juliá as Chairman of the Board and his subsequent appointment as Honorary Chairman, as well as the appointment as Chairman of Mr Gabriel Escarrer Jaume, who now holds the positions of Chairman of the Board and Chief Executive Officer. The Company also undertook the partial renewal and reinforcement of its Senior Executive Team last June.

With 54.54% of Independent Directors and 36.36% of female Directors, the Company complies with Recommendation No. 34 of the Good Governance Code by giving more weight to the Lead Independent Director, and reaffirms its resolve to meet the 40% target of female Directors which is also established by the Code.