Gabriel Escarrer Jaume, Executive Vice President and CEO of Meliá Hotels International:

“The results of the first quarter contain no surprises given the stagnation in demand created by a third wave of the pandemic that came before having achieved immunity in most countries. Our company therefore maintained the activation of its Contingency Plan, guaranteeing the required levels of liquidity and reducing operating expenses by 54.2% over the period, at the same time ramping up our digitalisation, the implementation of a new operating model, and progress with our ESG strategy.

However, we remain optimistic about the next few months, in which, with the greatest degree of prudence and respect for health and safety recommendations, we expect to return to near-normal levels in resort hotels. Along with progress with vaccinations in key markets and travel destinations (at least with the first dose), the key to recovery in the upcoming summer season will undoubtedly be the implementation of reliable, standardised digital health control and coordination systems.

We are confident that the strong upturn in demand we have already seen from the US market to the Caribbean, thanks to an efficient vaccination programme and the prioritisation of health measures in destinations such as the Dominican Republic and Mexico, will lead the way in a reactivation that is also beginning to be seen in other markets and destinations and will form the basis of a solid and consistent recovery, which Meliá will be in a position to lead thanks to the competitive advantage provided by its direct channels."

The third wave of the pandemic, with outbreaks of several different strains and even tougher travel restrictions in most countries, made the results of the first quarter similar to those of the fourth quarter of 2020, with over 50% less rooms on offer compared to the first quarter of 2020 and an occupancy level of 19.7% (32.5% less than in the previous year). Demand was almost exclusively focused on domestic markets, and there was no activity in international travel nor in corporate travel nor MICE (congresses, meetings and incentives).

Meliá Hotels International presents an attributed net result of -€130.9M for the first quarter of 2021, with €76.3M in revenues, 73.9% less than in the same period in 2020, which was a largely normal quarter until the declaration of a pandemic in late March. Negative EBITDA of -€51.2M is -460.4% less than in the same period in 2020, making it impossible to compare results between the two periods given the collapse in demand in the first three months of 2021.

As a result of these circumstances, the company has kept its contingency plan against Covid active, tactically managing hotel closures and reopening, rigorously containing operating expenses (down by -54.2% compared to 2020 and -57.9% compared to 2019). In line with the work started in 2020, the company also continues to negotiate and reach agreements with certain suppliers and the owners of leased hotels through different types of agreements: rate reductions, moratoriums, waivers, etc.

In terms of operations, Meliá now has 100% of its hotels in Asia Pacific open and 80% in America. In Spain it expects to open at least 110 hotels for the month of June, (more than 70% of the portfolio in the country). In the last week, the company has announced the opening of some of its bigger resort hotels in the Balearic Islands, such as the Meliá Calviá Beach and Hotel de Mar Gran Meliá in Mallorca, the Meliá Cala Galdana and Sol Falcó in Menorca, and the ME by Meliá and Sol Beach House hotels in Ibiza.

During the pandemic, the Group consolidated its commitment to its direct sales channels, melia.com and MeliáPRO, and its MeliaRewards loyalty programme, the source of 55% of the company's sales in the first quarter. Direct channels were the most resilient, followed by OTAs and Tour Operators. In addition to being leaders in distribution, over the last year Meliá has also been focused on a comprehensive digital transformation of the company, simultaneously working on internal management processes, procurement, financial management, reservations and the customer experience. The company is also restructuring its operating model to optimise its corporate and operations structure in the face of the extremely competitive nature of the new post-Covid business environment, in which there is expected to be strong price tension and a consequent need to adjust costs, making the company simpler, more agile in its decision-making, more efficient and more sustainable.

Despite the "stand-by" situation in the industry, the company has continued to seek to grow and extend its portfolio through various formulas, and especially through its new "Affiliated by Meliá" concept. This allows Meliá to add independent hotels to the chain which continue to retain their own particular essence and identity while enjoying the benefits of access to the distribution platform of a leading international hotel company with more than 14 million loyal customers (77% of them outside Spain). In today's hotel industry, Meliá's global distribution platform and the strength of its melia.com direct channel allow independent hotels without their own distribution structures to respond to new consumer trends and the increasing digitalisation of hotel distribution.

In the financial area, one of the company's top priorities is still to retain a liquidity position that allows it to face the coming months with a certain peace of mind. To this end, the company has already refinanced all the debt which matured in 2021, and is exploring alternative ways to get greater liquidity and reduce debt, such as asset sales for an amount between €150M and € 200M, which it hopes to carry out shortly. During the first quarter of the year, Net Debt increased by €143.6M, reaching €2,747.4M at the end of March. At the end of March, the liquidity situation (including liquid assets and undrawn credit lines) amounts to €230M.

Greater digitalisation for the post-Covid business environment

Digital transformation is still considered to be key in the adaptation and response of the company to the current business context, and it continues to add new technology and solutions with a 360º vision. After having consolidated its digital sales and distribution model over recent years, the company is now making progress in the digitalisation of the in-room experience, offering new services in the Meliá APP and contactless experiences using QR codes as part of its Stay Safe With Meliá programme, designed to create a more digital and safer customer experience.

From the point of view of the employee experience, the company has added new technology to boost the digitalisation of processes and efficiency, as well as others to allow transactional tasks to be carried out automatically and remotely through Robotic Process Automation (RPA). Meliá is a pioneer in the deployment of this technology in the hotel industry and, after a year of experience with the technology, it is now present in 30% of the regions with a total of 30 software robots now at work.

Impact of COVID-19 by markets

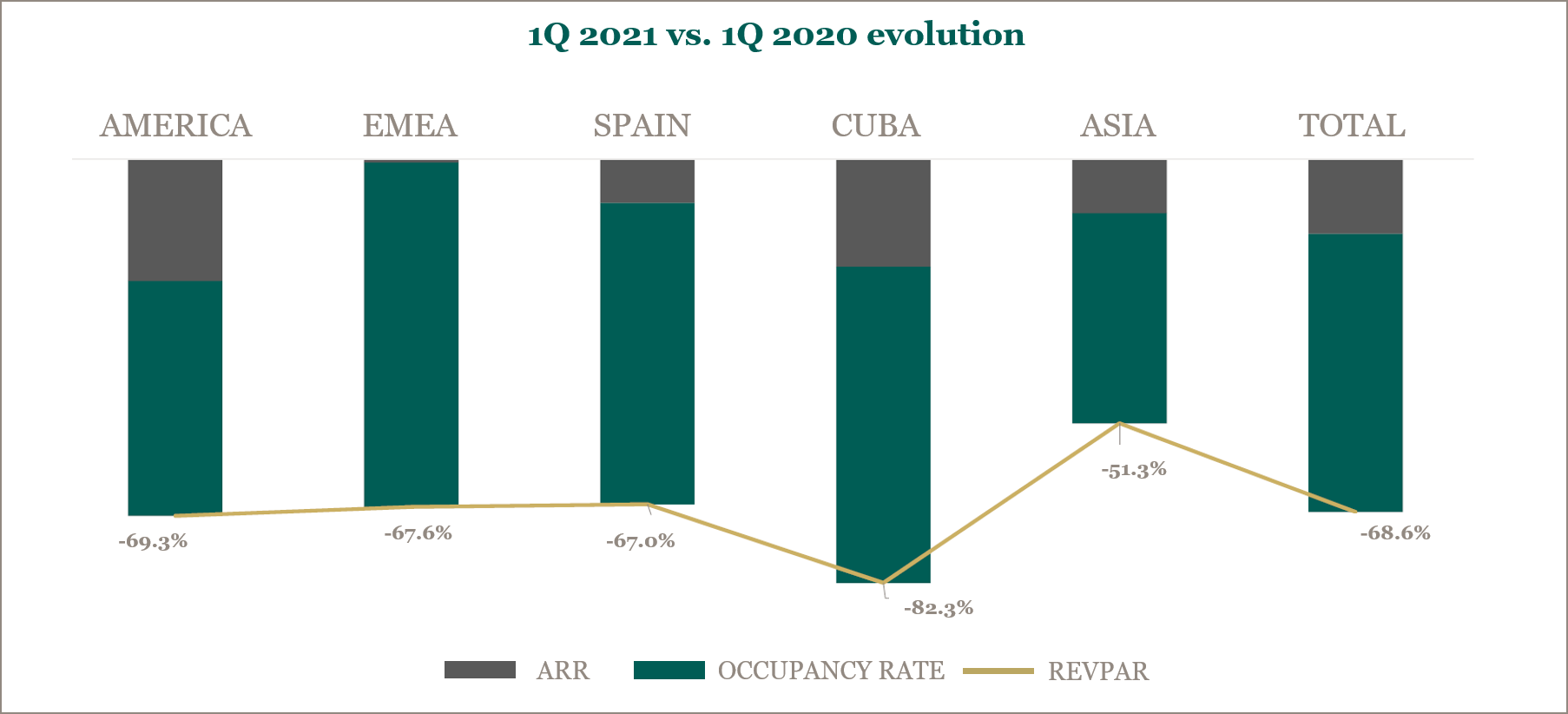

RevPAR performance was negative in all regions: -67% in Spain, -69.3% in America, -67.6% in EMEA, -82.3% in Cuba and -51.3% in Asia Pacific. The situation in China is different, as demand is beginning to recover (currently only domestic demand) and Vietnam is also beginning to recover, unlike other Southeast Asian countries such as Indonesia, Malaysia, Thailand and Myanmar. All of the company's hotels in Asia Pacific are open. In Spain, with the majority of hotels closed due to travel restrictions between Spanish regions and in other countries, the largest amount of resort business was concentrated in the Canary Islands, and specifically in the Gran Meliá Palacio de Isora in Tenerife. In urban hotels, cities such as Madrid, Barcelona and Palma were the ones most affected by the absence of the MICE segment.

Green shoots of recovery in hotel demand

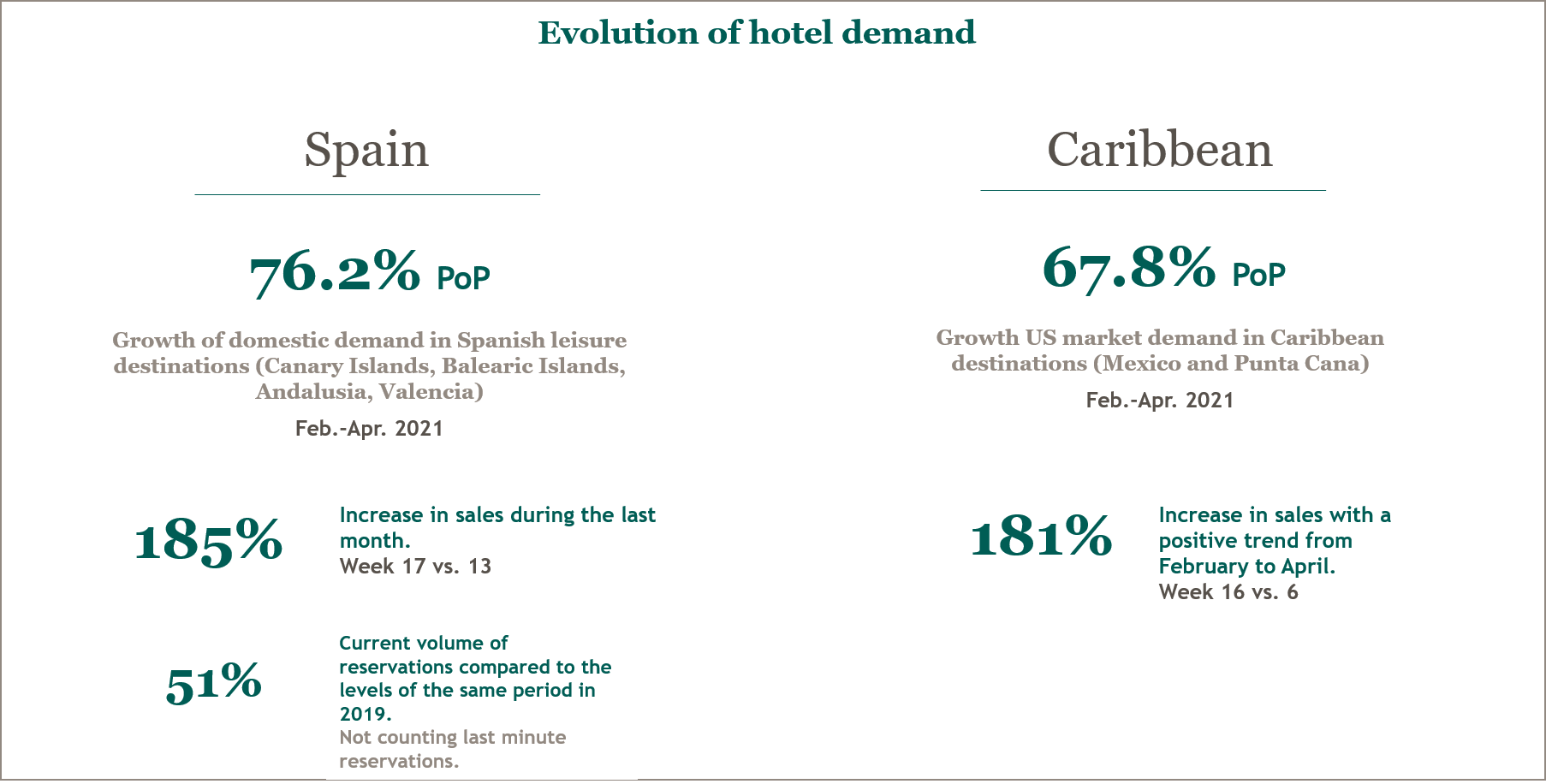

Although short-term visibility remains very limited, indicators point towards a gradual recovery starting in May, provided progress continues to be made with vaccination programmes and the relaxing of travel restrictions, allowing a good summer and a correct performance in the fourth quarter. Growth over the last few weeks in bookings from Spain for holiday destinations in Spain, and from the US market for Caribbean destinations, invite us to be optimistic, particularly in Mexico, where booking numbers have already reached 2019 levels.

The company expects to open at least 70% of its hotel portfolio in Spain for the summer, prioritising resort hotels. The evolution will depend on the relaxation of travel restrictions in key source markets, particularly the United Kingdom and Germany. Reports suggest that Spain will be seen as an "amber" destination in the Covid traffic-light system proposed by the British authorities (maintaining the requirement for a PCR test for travellers, with the possibility of the Canary Islands and Balearic Islands being classified as “green" due to the fact that they are islands).

The evolution of bookings in the Spanish market for Spanish holiday destinations has shot up 76% in the last 4 weeks, encouraged by the prospect of the end of the state of emergency and elimination of restrictions on travel between regions of the country, and bookings now are above 50% the same period in 2019. In the British market, the uncertainty regarding the date from which the authorities will allow travel and the nature of the restrictions has put a brake on the upward trend in bookings that began in February with the first announcements of the relaxation of travel restrictions.

In EMEA, despite continuing uncertainty, the gradual relaxation of restrictions expected in May and June should allow a gradual recovery. Forecasts for Germany see all the hotels open in June, and in the United Kingdom the hotels in London, Manchester and Newcastle should be open in May. In Paris the company will open two hotels between May and June, and will increase the number of hotels open as market potential increases.

In America, Caribbean destinations, particularly Mexico, (where sales are already at 2019 levels) have seen strong sales in recent weeks, allowing all the company's hotels to remain open and with positive operating results. The number of hotel searches in the United States for hotels in Mexico and the Dominican Republic increased by 70% over the last 12 weeks. This positive evolution is also seen in the number of flights booked for the destinations, which has recovered a large part of the lost ground and is now only -21% below the 2nd quarter of 2019. In the Dominican Republic, the government's commitment to the safety of tourist destinations, including the vaccination of tourism industry workers, is having a favourable impact on traveller confidence. In both destinations, a recovery in demand is even beginning to be seen in the MICE segment, the segment most affected by the pandemic, both for 2022 and 2023.

In Cuba, after the major impact of the pandemic, more hopeful news is beginning to emerge, such as the recovery of seven weekly flights from Russia to Varadero as of April 18, and the intention shown by Canadian and Latin American companies to resume operations as of July, in addition to a mass vaccination campaign that the country is expected to start in June and July, thanks to the progress made with two candidates for anti-Covid-19 vaccines made in Cuba.

The best current forecasts are for hotels in Asia, and especially in China, which could already reach the numbers achieved in the second quarter of 2019 despite the continued absence of international travellers. In Vietnam, a positive performance in resort hotels has been seen since April, although border restrictions and quarantines remain in place.

For Gabriel Escarrer, “although short-term visibility is still very limited, the number of online bookings and searches, the consistent increase in bookings, the progress with vaccinations, and the relaxation of travel restrictions in our key markets, invite us to enjoy a certain degree of optimism. We trust that the vaccination process and the coordination between countries to encourage "safe travel" will allow us to continue improving bookings and the activity of our hotels and destinations, something which is so necessary both for Meliá and for society in general."